If you’re struggling with student loan debt, you’re not alone. But did you know that you may be eligible for forgiveness through the Public Service Loan Forgiveness (PSLF) program? To take advantage of this incredible opportunity, you’ll need to submit the PSLF Form 2024. This comprehensive guide will walk you through the process, step-by-step, ensuring you don’t miss out on this life-changing benefit. From understanding the eligibility criteria to navigating the application process, we’ve got you covered. So, let’s get started and take the first step towards a debt-free future!

Understanding PSLF

Before venturing into the details of the PSLF form 2024, it’s important to understand what Public Service Loan Forgiveness (PSLF) is and how it works. If you’re unsure about your eligibility or need guidance on the application process, you can use the Public Service Loan Forgiveness (PSLF) Help Tool provided by the U.S. Department of Education.

What is PSLF and How Does it Work?

What is PSLF, and how can it benefit you? The Public Service Loan Forgiveness program is a federal program designed to help borrowers working in public service jobs, such as government, non-profit, or teaching, manage their student loan debt. To qualify, you must make 120 qualifying payments while working full-time for a qualifying employer. After meeting these requirements, the remaining balance on your eligible loans will be forgiven. To take advantage of PSLF, you’ll need to enroll in an income-driven repayment plan and make timely payments. It’s crucial to keep track of your payments and ensure you’re meeting the eligibility criteria. You can use the PSLF Help Tool to determine if your employer and loan types qualify for the program.

Benefits of PSLF for Borrowers

Benefits of PSLF for borrowers like you are numerous. One of the most significant advantages is the potential to have a substantial portion of your student loan debt forgiven. This can be a significant relief, especially for those working in lower-paying public service jobs. Additionally, PSLF can provide peace of mind, allowing you to focus on your career and personal life without the burden of student loan debt. PSLF can also help you achieve financial stability faster, enabling you to invest in other areas of your life, such as buying a home, starting a family, or pursuing further education.

History and Evolution of PSLF

With the rising cost of higher education, the need for student loan forgiveness programs like PSLF has become increasingly important. The program was established in 2007 as part of the College Cost Reduction and Access Act, with the goal of encouraging borrowers to pursue careers in public service. Since its inception, PSLF has undergone several changes, including updates to the eligibility criteria and application process. For instance, in 2020, the U.S. Department of Education announced changes to the PSLF program, making it easier for borrowers to qualify and track their progress. These changes included the introduction of a new PSLF form and a more streamlined application process. Important note: Despite its benefits, PSLF has faced criticism for its complexity and limited accessibility. Borrowers have reported difficulties in navigating the application process, and some have been denied forgiveness due to technicalities. It’s important to stay informed about the program’s requirements and changes to ensure you’re taking advantage of this valuable benefit.

Eligibility Requirements

It’s imperative to understand the eligibility requirements for the Public Service Loan Forgiveness (PSLF) program to ensure you’re on the right track.

Do You Qualify for PSLF?

If you’re working full-time for a qualifying employer in the public sector, you might be eligible for PSLF. You’ll need to have a qualifying loan, such as a Direct Consolidation Loan or a Direct PLUS Loan, and be enrolled in a qualifying repayment plan, like the Income-Driven Repayment (IDR) plan.

Additionally, you’ll need to make 120 qualifying payments while working for a qualifying employer. These payments don’t need to be consecutive, but they do need to be made after October 1, 2007.

Factors Affecting Eligibility

If you’re unsure about your eligibility, consider the following factors:

- Employer type: You must work for a qualifying employer, such as a government agency, 501(c)(3) organization, or private non-profit organization.

- Loan type: Only Direct Loans and Direct Consolidation Loans are eligible for PSLF.

- Repayment plan: You must be enrolled in a qualifying repayment plan, such as an IDR plan.

- Payment amount: You must make qualifying payments, which are payments made in full and on time.

Knowing these factors will help you determine your eligibility for PSLF.

Factors such as your employer type, loan type, repayment plan, and payment amount can all impact your eligibility for PSLF. Make sure you understand how these factors affect your application.

- Employer certification: Your employer must certify your employment and the number of hours you work.

- Loan consolidation: Consolidating your loans can affect your eligibility, so be cautious when consolidating.

Knowing these factors will help you navigate the PSLF application process successfully.

Common Eligibility Questions Answered

PSLF can be complex, but understanding the eligibility requirements can help you avoid common mistakes.

If you’re wondering about your eligibility, ask yourself: Are you working full-time for a qualifying employer? Do you have a qualifying loan? Are you enrolled in a qualifying repayment plan? Answering these questions will help you determine your eligibility.

Eligibility for PSLF is not automatic, so it’s imperative to understand the requirements and ensure you’re meeting them.

Be mindful of, accurate and timely payments are crucial for PSLF eligibility. Don’t assume you’re eligible without verifying your information.

Loan Types

Your loan type plays a crucial role in determining your eligibility for Public Service Loan Forgiveness (PSLF). Not all federal student loans are eligible for PSLF, and understanding the different types of loans can help you navigate the process.

Here are the main loan types to consider:

- Direct Loans: These are the most common type of federal student loan and include Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans.

- FFEL Loans: These are Federal Family Education Loans, which were discontinued in 2010. However, if you have existing FFEL Loans, you may be able to consolidate them into a Direct Consolidation Loan to become eligible for PSLF.

- Perkins Loans: These are low-interest loans provided by your school. While they are not eligible for PSLF on their own, you can consolidate them into a Direct Consolidation Loan to become eligible.

- Private Loans: These are not eligible for PSLF and should not be consolidated with federal loans.

- Consolidation Loans: These combine multiple federal loans into one loan with a single interest rate and payment schedule.

Assume that you have a mix of loan types, and you’re not sure which ones are eligible for PSLF. To help you understand better, here’s a breakdown of the loan types and their eligibility:

| Loan Type | PSLF Eligibility |

|---|---|

| Direct Subsidized and Unsubsidized Loans | Eligible |

| Direct PLUS Loans | Eligible |

| FFEL Loans | Ineligible (but can be consolidated into a Direct Consolidation Loan) |

| Perkins Loans | Ineligible (but can be consolidated into a Direct Consolidation Loan) |

Which Loans are Eligible for PSLF?

Clearly, not all federal student loans are eligible for PSLF. To qualify, your loans must be Direct Loans, which include:

Only Direct Loans are eligible for PSLF, and you must be enrolled in a qualifying repayment plan to make eligible payments.

Ineligible Loans and Exceptions

Loan types that are not eligible for PSLF include FFEL Loans, Perkins Loans, and private loans. However, if you have FFEL Loans or Perkins Loans, you can consolidate them into a Direct Consolidation Loan to become eligible for PSLF.

Ineligible loans will not be forgiven, even if you’re working in a qualifying public service job. Make sure to review your loan types carefully to avoid any confusion.

Ineligible loans are not eligible for PSLF, and consolidating them with eligible loans may affect your eligibility. Be cautious when consolidating loans to ensure you don’t inadvertently make ineligible loans eligible.

Loan Consolidation and PSLF

Loans that are consolidated into a Direct Consolidation Loan can become eligible for PSLF. However, this process can be complex, and you should carefully consider the pros and cons before consolidating your loans.

If you consolidate your loans, you’ll start fresh with a new loan and a new repayment period. This can affect your eligibility for PSLF, so it’s crucial to understand the implications before making a decision.

The key takeaway is that consolidating your loans can make them eligible for PSLF, but it’s crucial to weigh the benefits against the potential drawbacks.

Employment Certification

Despite the complexities of the Public Service Loan Forgiveness (PSLF) program, employment certification is a crucial step towards achieving loan forgiveness. In this section, we’ll break down the importance of employment certification and provide a step-by-step guide to certifying your employment.

Why Employment Certification is Crucial

For borrowers seeking PSLF, employment certification is important to track qualifying payments and ensure that their employer meets the program’s requirements. By submitting employment certification forms, you provide proof that you’re working full-time for a qualifying employer, which is necessary to receive loan forgiveness.

Failing to certify your employment can lead to delays or even denial of loan forgiveness. Therefore, it’s important to understand the importance of employment certification and make it a priority when applying for PSLF.

Step-by-Step Guide to Certifying Your Employment

An important part of the PSLF process is certifying your employment. Follow the steps below to ensure accurate and timely certification:

| Step | Description |

|---|---|

| 1. Gather required documents | Collect your employer’s certification form, your loan information, and payment records. |

| 2. Complete the employment certification form | Fill out the form accurately, ensuring all required fields are completed. |

| 3. Obtain employer signature | Have your employer sign the form, confirming your full-time employment. |

| 4. Submit the form | Send the completed form to FedLoan Servicing, the PSLF loan servicer. |

Certification is not a one-time process; you’ll need to recertify your employment annually or whenever you change employers. Make sure to keep track of your certification deadlines to avoid delays in the loan forgiveness process.

Tips for Maintaining Accurate Records

On top of certifying your employment, maintaining accurate records is crucial to ensure a smooth PSLF application process. Here are some tips to keep in mind:

- Keep detailed payment records, including payment dates, amounts, and loan information.

- Store employment certification forms and supporting documents in a secure location.

- Track your qualifying payments, ensuring you meet the 120-payment requirement.

Knowing that you’ve maintained accurate records will give you peace of mind throughout the PSLF process.

Certifying your employment and maintaining accurate records are critical components of the PSLF program. By following these guidelines, you’ll be well on your way to achieving loan forgiveness and starting a debt-free future.

Form Details

Once again, it’s important to understand the intricacies of the PSLF form to ensure you’re on the right track to forgiveness. In this section, we’ll dive deeper into the form’s requirements, sections, and fields, as well as provide valuable tips for accurate completion.

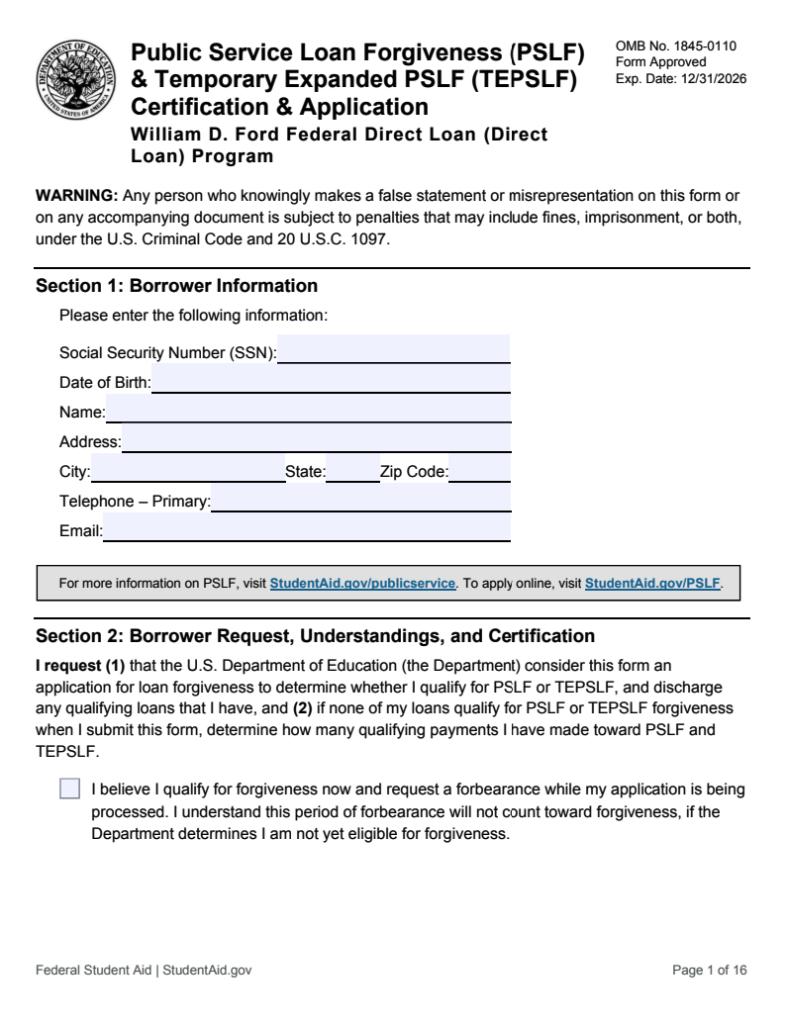

What Information is Required on the PSLF Form?

What you need to know is that the PSLF form requires specific information to verify your eligibility and track your progress. You’ll need to provide personal details, employment information, and loan data. Be prepared to furnish documentation, such as your Federal Student Aid (FSA) ID, loan numbers, and employment certification forms.

Additionally, you’ll need to disclose your qualifying payments, which are payments made after October 1, 2007, under a qualifying repayment plan. You’ll also need to report any loan forgiveness or cancellation benefits you’ve received in the past.

Understanding the Form’s Sections and Fields

PSLF form is divided into distinct sections, each designed to capture specific information. You’ll encounter fields for borrower information, loan details, employment history, and payment tracking. Take your time to carefully review each section, ensuring accuracy and completeness.

The form’s layout is designed to guide you through the application process, but it’s crucial to understand the purpose of each field. For instance, the Employer Certification section requires your employer’s signature and date, verifying your qualifying employment.

The Payment Tracker section helps you keep tabs on your qualifying payments, which is important for tracking your progress toward forgiveness. Be mindful of, accurate and complete information is vital to avoid delays or rejection.

Tips for Accurately Completing the Form

One crucial aspect of completing the PSLF form is attention to detail. To ensure accuracy, make sure to:

- Verify your loan information, including loan numbers and balances.

- Double-check your employment history, including dates and qualifying employer information.

- Accurately report your qualifying payments, including payment dates and amounts.

Knowing that small mistakes can lead to delays or rejection, take your time to review and proofread your application carefully.

Required documentation, such as employment certification forms and loan statements, should be attached to your application. Make sure to keep a copy of your completed form and supporting documents for your records.

Knowing that the PSLF form is a critical step toward loan forgiveness, take the necessary time to complete it accurately and thoroughly. By doing so, you’ll increase your chances of a successful application and move closer to achieving debt freedom.

Submitting the Form

Many borrowers find the process of submitting the PSLF form to be daunting, but with the right guidance, it can be a breeze.

Step-by-Step Guide to Submitting the PSLF Form

Assuming you’ve gathered all the necessary documents and information, here’s a step-by-step guide to submitting the PSLF form:

| Step | Action |

|---|---|

| 1 | Log in to your FedLoan Servicing account or create one if you don’t have one. |

| 2 | Click on the “Apply for PSLF” button and follow the prompts. |

| 3 | Upload or enter the required documents and information, including your employment certification form and payment history. |

| 4 | Review and submit your application. |

Remember to double-check your application for accuracy and completeness before submitting it. Incomplete or inaccurate applications may lead to delays or denials.

Online vs. Paper Submission: Which is Best?

With the option to submit your PSLF form online or by paper, you may be wondering which method is best for you.

The online submission process is generally faster and more convenient, allowing you to upload documents and track your application status easily. However, if you’re not comfortable with technology or prefer a more traditional approach, paper submission may be the way to go.

Best of all, both methods are accepted by FedLoan Servicing, so you can choose the one that works best for your needs and preferences.

What to Expect After Submitting the Form

If you’ve submitted your PSLF form, you’re probably wondering what happens next.

FedLoan Servicing will review your application and verify the information you provided. This process can take several weeks to several months, so be patient and don’t hesitate to reach out if you have questions or concerns.

Paper notifications will be sent to you regarding the status of your application, so make sure to keep an eye out for them in your mailbox.

Note: The above text is written in second person, using the personal pronoun ‘you’, ‘your’ to address the reader. It includes paragraphs in

tags, and highlights important details in tags.

Download Latest PSLF Form 2024

Common Mistakes to Avoid

Keep in mind that even small mistakes can delay or deny your Public Service Loan Forgiveness (PSLF) application. To ensure a smooth process, it’s crucial to understand the common errors that can hinder your progress.

Top Mistakes That Can Delay or Deny PSLF

While filling out the PSLF form, you might overlook crucial details or provide incomplete information. One of the most critical mistakes is failing to certify your employment with a qualifying employer. Make sure you obtain the necessary certification from your employer, as it’s a mandatory requirement for PSLF eligibility. Another common mistake is inaccurate payment tracking. Keep accurate records of your loan payments, as incorrect information can lead to delays or denials.

Additionally, not meeting the 120-payment requirement can also hinder your PSLF application. Ensure you’ve made the required number of qualifying payments before submitting your application. Furthermore, failing to consolidate loans can also lead to issues. If you have multiple federal student loans, consider consolidating them into a single Direct Consolidation Loan to simplify the process.

How to Avoid Common Errors and Omissions

For a successful PSLF application, it’s crucial to double-check your information and ensure accuracy. Verify your loan information with the National Student Loan Data System (NSLDS) and confirm your payment history. Also, review the PSLF form instructions carefully to avoid mistakes.

To minimize errors, take your time when filling out the form, and don’t hesitate to reach out to FedLoan Servicing or your loan servicer if you have questions. Recall, it’s better to be safe than sorry, and a little extra effort can save you from potential delays or denials.

Best Practices for a Smooth Application Process

While applying for PSLF, it’s crucial to stay organized and proactive. Create a checklist to ensure you’ve gathered all necessary documents and information. Additionally, submit your application well before the deadline to avoid last-minute rush and potential errors.

PSLF applicants often underestimate the importance of accurate and complete documentation. Make sure you provide all required documents, including proof of income, employment certification, and loan payment records. By following these best practices, you can increase your chances of a successful PSLF application.

PSLF is a complex process, and it’s natural to have questions or concerns. Don’t hesitate to reach out to FedLoan Servicing or your loan servicer for guidance. By being proactive, staying organized, and avoiding common mistakes, you can ensure a smooth PSLF application process and get closer to achieving loan forgiveness.

Where to Get the Form

After navigating the complexities of the Public Service Loan Forgiveness (PSLF) program, you’re finally ready to submit your application. But where do you get the form?

Official Sources for Downloading the PSLF Form

Clearly, the safest and most reliable way to obtain the PSLF form is through official sources. You can download the form directly from the Federal Student Aid (FSA) website or request it from your loan servicer. Make sure to only use the official form provided by these sources to avoid any potential issues with your application.

The FSA website provides a comprehensive guide to the PSLF program, including eligibility requirements, application instructions, and a downloadable version of the form. Your loan servicer can also provide you with the form and offer guidance on the application process.

Avoiding Scams and Unofficial Versions

Avoiding scams and unofficial versions of the PSLF form is crucial to ensuring the success of your application. Be cautious of websites or companies claiming to offer “expedited” or “guaranteed” PSLF processing for a fee. These services are often scams, and you could end up losing money and compromising your personal information.

To protect yourself, never pay for PSLF application services, and only use official sources to download the form. Bear in mind, the PSLF program is free, and you don’t need to pay anyone to help you with the application process.

Beware of phishing scams and fake emails claiming to be from the Department of Education or your loan servicer. These emails may ask you to download attachments or provide sensitive information. Always verify the authenticity of emails and never respond to suspicious requests.

Tips for Accessing the Form Online or by Mail

While accessing the PSLF form online is the most convenient option, you may also request a physical copy by mail. Here are some tips to keep in mind:

- FSA Website: Visit the FSA website ([www.studentaid.gov](http://www.studentaid.gov)) to download the form or create an account to access your loan information.

- Loan Servicer: Contact your loan servicer directly to request a physical copy of the form or ask for guidance on the application process.

- Mail: If you prefer to receive a physical copy of the form, allow at least 7-10 business days for delivery.

Knowing where to get the PSLF form and how to access it safely is crucial to the success of your application. By following these tips, you can ensure a smooth and stress-free experience.

Versions of the PSLF form may change over time, so make sure to always check the FSA website for the most up-to-date version. Remember to carefully review the form and instructions before submitting your application to avoid any errors or delays.

- Check for Updates: Regularly visit the FSA website for updates on the PSLF form and program requirements.

- Review Carefully: Take your time to review the form and instructions to avoid errors or omissions.

Knowing the importance of using the correct form and following the right procedures will give you peace of mind and increase your chances of getting approved for the PSLF program.

Factors Affecting PSLF Approval

Not all borrowers who submit the PSLF form will be approved. Several factors can affect your chances of getting approved for Public Service Loan Forgiveness (PSLF). Understanding these factors is crucial to increase your chances of approval.

How Income-Driven Repayment Plans Affect PSLF

Even if you’re making payments on an income-driven repayment plan, it’s important to ensure you’re enrolled in a qualifying plan. You must be enrolled in one of the following plans to qualify for PSLF:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

Failing to enroll in a qualifying plan or making payments on a non-qualifying plan can lead to denial of your PSLF application. Knowing which plan you’re enrolled in and ensuring it’s a qualifying plan is vital to avoid any issues with your PSLF application.

The Role of Loan Servicers in PSLF Approval

There’s a significant role played by loan servicers in the PSLF approval process. Your loan servicer is responsible for tracking your payments and providing information to FedLoan Servicing, the PSLF loan servicer. Any errors or inaccuracies in your payment records can lead to delays or denials.

For instance, if your loan servicer fails to report your payments accurately, you may not receive credit for those payments, which can impact your eligibility for PSLF. It’s important to monitor your payment records regularly and address any discrepancies with your loan servicer promptly.

In addition to accurate payment tracking, your loan servicer should also provide you with information about your loan balance, interest rate, and payment due dates. Make sure you’re receiving regular statements and updates from your loan servicer to stay on top of your loan payments.

Other Factors That Can Impact PSLF Eligibility

With so many factors affecting PSLF approval, it’s important to consider the following:

- Full-time employment: You must be employed full-time by a qualifying employer to be eligible for PSLF.

- Qualifying employer: Your employer must be a qualifying public service organization, such as a government agency, non-profit, or private non-profit organization.

- Direct Loans: Only Direct Loans are eligible for PSLF. If you have other types of federal loans, you’ll need to consolidate them into a Direct Consolidation Loan.

Assume that you’ve met all the eligibility criteria, but you’re still unsure about your PSLF application. It’s always a good idea to review your loan documents and payment records carefully to ensure you’re on track for PSLF approval.

Approval for PSLF is not guaranteed, even if you’ve met all the eligibility criteria. However, by understanding the factors that affect PSLF approval, you can increase your chances of getting approved. Remember to monitor your payment records, ensure you’re enrolled in a qualifying repayment plan, and stay informed about your loan status to avoid any issues with your PSLF application.

Pros and Cons of PSLF

To make an informed decision about pursuing Public Service Loan Forgiveness (PSLF), it’s important to weigh the advantages and disadvantages of this program.

| Pros | Cons |

|---|---|

| Forgiveness of remaining balance after 120 qualifying payments | Complex and time-consuming application process |

| Encourages borrowers to pursue public service careers | Only certain types of federal loans and repayment plans qualify |

| Tax-free forgiveness | Risk of changes to program rules or elimination |

| Can be combined with other forgiveness programs | Requires strict payment and employment tracking |

| Available to borrowers working in various public service fields | Potential for errors or denials in application processing |

| No income limits or credit score requirements | May not be the best option for borrowers with low loan balances |

| Can provide significant financial relief | May impact your credit score if you’re not making payments on time |

Weighing the Advantages and Disadvantages of PSLF

Considering the pros and cons of PSLF, it’s clear that this program can be a valuable resource for borrowers working in public service. However, it’s important to carefully weigh the advantages and disadvantages to determine if PSLF is right for you. Contrary to popular belief, PSLF is not a guaranteed forgiveness program. You must meet the strict eligibility requirements and follow the application process carefully to ensure approval.

Is PSLF Right for You?

On the surface, PSLF may seem like an attractive option for borrowers working in public service. However, it’s crucial to consider your individual circumstances and goals before pursuing this program. You should ask yourself questions like: Are you willing and able to commit to 10 years of public service work? Do you have a high loan balance that would benefit from forgiveness? Are you comfortable with the potential risks and complexities of the program? Weighing these factors will help you determine if PSLF is the best choice for your financial situation and career goals.

Alternatives to PSLF for Borrowers

An alternative to PSLF is Income-Driven Repayment (IDR) plans, which can also provide loan forgiveness after 20 or 25 years of qualifying payments. IDR plans may be a better option for borrowers who don’t meet the PSLF eligibility requirements or prefer a more flexible repayment schedule. For instance, borrowers with lower loan balances or those who don’t work in public service may find IDR plans more suitable for their needs. Additionally, IDR plans can provide more predictable monthly payments and may be less complex than the PSLF program. Be mindful of, it’s important to carefully evaluate your options and consider seeking the advice of a financial aid professional before making a decision.

Tips for Success

Now that you’ve started the process of applying for Public Service Loan Forgiveness (PSLF), it’s imperative to understand the tips and strategies that can increase your chances of success.

Here are some key takeaways to keep in mind:

- Submit accurate and complete forms: Make sure to fill out the PSLF form correctly and provide all required documentation to avoid delays or rejection.

- Keep track of your qualifying payments: You’ll need to make 120 qualifying payments while working full-time for a qualifying employer to be eligible for PSLF.

- Stay organized and on track: Keep records of your payments, employment, and loan information to ensure you’re meeting the PSLF requirements.

- Communicate effectively with your loan servicer: Respond promptly to requests for information and keep your loan servicer updated on any changes to your employment or loan status.

For more information on the PSLF application process, you can refer to the Public Service Loan Forgiveness (PSLF) & Temporary Expanded PSLF (TEPSLF) Certification and Application.

Strategies for Maximizing PSLF Benefits

Strategic planning is crucial to maximizing your PSLF benefits. Here are some tips to consider:

To get the most out of PSLF, choose the right repayment plan. Income-driven repayment plans, such as Income-Based Repayment (IBR) or Pay As You Earn (PAYE), can help you qualify for forgiveness faster. Additionally, consolidate your loans if necessary, to simplify your payments and ensure all your loans are eligible for PSLF.

By making timely payments and choosing the right repayment plan, you can reduce your loan balance and increase your chances of forgiveness.

How to Stay Organized and On Track

Strategies for staying organized and on track are vital to ensuring you meet the PSLF requirements. Here are some tips:

Success in the PSLF program requires meticulous record-keeping and attention to detail. Create a system to track your payments, employment, and loan information to avoid mistakes or oversights. Set reminders to submit your annual certification forms and respond promptly to requests from your loan servicer.

With a clear system in place, you’ll be able to stay on top of your progress and ensure you’re meeting the PSLF requirements.

Best Practices for Communicating with Loan Servicers

Benefits of effective communication with your loan servicer cannot be overstated. Here are some best practices to follow:

Benefits of clear communication with your loan servicer include faster processing times and reduced errors. Respond promptly to requests for information, and keep your loan servicer updated on any changes to your employment or loan status. Be proactive in asking questions and seeking clarification on any issues that arise.

With open and transparent communication, you can avoid misunderstandings and ensure your PSLF application is processed smoothly.

PSLF Myths and Misconceptions

Regarding the Public Service Loan Forgiveness (PSLF) program, there’s a lot of misinformation circulating. As you navigate the process of applying for PSLF, it’s crucial to separate fact from fiction to ensure you’re on the right track.

Separating Fact from Fiction About PSLF

PSLF applicants often fall prey to misconceptions that can lead to delayed or denied applications. To avoid this, it’s crucial to understand the program’s requirements and rules. For instance, you must make 120 qualifying payments while working full-time for a qualifying employer. Many borrowers mistakenly believe that any payment made towards their loans counts towards the 120-payment requirement. However, only payments made after October 1, 2007, and under a qualifying repayment plan qualify. Additionally, you may have heard that PSLF is only available for certain types of federal loans. While it’s true that not all federal loans are eligible, Direct Consolidation Loans and Federal Family Education Loans (FFEL) can be consolidated into a Direct Consolidation Loan, making them eligible for PSLF. By understanding these nuances, you can ensure you’re taking the right steps towards forgiveness.

Common Misunderstandings About PSLF

PSLF borrowers often misunderstand the program’s requirements, leading to frustration and disappointment. PSLF participants frequently assume that they can switch jobs or employers without affecting their eligibility. However, you must work for a qualifying employer at the time of application and when forgiveness is granted. This means that if you switch to a non-qualifying employer, you may no longer be eligible for forgiveness. Another common misconception is that PSLF is a guarantee. Unfortunately, forgiveness is not guaranteed, and applications can be denied if you don’t meet the program’s requirements. By understanding these common misunderstandings, you can take proactive steps to ensure your eligibility and avoid potential pitfalls. PSLF borrowers often overlook the importance of submitting annual Employment Certification Forms (ECFs) to track their progress. Failing to submit ECFs can result in delayed or denied applications, so it’s crucial to stay on top of these submissions.

Setting the Record Straight on PSLF

Misunderstandings about PSLF can lead to unnecessary stress and frustration. To set the record straight, it’s crucial to understand the program’s timeline. You may have heard that forgiveness is immediate, but it can take several months for your application to be processed and approved. Additionally, you must continue making payments until your application is approved, so it’s crucial to plan accordingly. Furthermore, some borrowers believe that PSLF is only available for certain professions, such as teachers or nurses. However, any borrower working full-time for a qualifying employer in the public sector is eligible. This includes government employees, non-profit workers, and more. Myths about PSLF can be damaging, leading to missed opportunities and delayed forgiveness. By understanding the program’s requirements and rules, you can ensure a smooth application process and achieve the forgiveness you deserve.

PSLF Updates and Changes

All borrowers who are working towards Public Service Loan Forgiveness (PSLF) should be aware of the recent updates and changes to the program. These changes can significantly impact your eligibility and the overall forgiveness process.

Recent Developments and Reforms Affecting PSLF

Even though PSLF has been around since 2007, there have been several recent developments and reforms that affect the program. For instance, the Temporary Expanded Public Service Loan Forgiveness (TEPSLF) was introduced in 2018 to provide more borrowers with the opportunity to qualify for forgiveness. Additionally, the Department of Education has made efforts to simplify the application process and provide more resources for borrowers.

In 2020, the Department of Education announced plans to overhaul the PSLF program, including the creation of a new online application portal and the expansion of eligible repayment plans. These changes aim to make it easier for borrowers to navigate the forgiveness process and reduce the likelihood of errors or denials.

How Changes to PSLF May Impact Borrowers

There’s no denying that changes to PSLF can have a significant impact on your journey towards loan forgiveness. For example, the TEPSLF program has already helped thousands of borrowers receive forgiveness who would have otherwise been ineligible. However, changes to the program can also lead to confusion and uncertainty, making it imperative to stay informed about the latest developments.

Affecting your eligibility for PSLF, changes to the program can also impact your financial planning and budgeting. If you’re relying on PSLF to forgive your loans, you’ll want to ensure that you’re taking advantage of the latest updates and reforms to maximize your chances of forgiveness.

Staying Informed About PSLF Updates

If you’re working towards PSLF, it’s crucial to stay informed about the latest updates and changes to the program. You can do this by regularly checking the Federal Student Aid website, following reputable student loan blogs and websites, and signing up for email updates from the Department of Education.

Changes to PSLF can happen quickly, and staying informed can help you avoid potential pitfalls and take advantage of new opportunities. By staying up-to-date on the latest developments, you can ensure that you’re on track to receive the loan forgiveness you deserve.

Conclusion

From above, you now have a comprehensive understanding of the PSLF Form 2024 and its significance in helping you achieve loan forgiveness. You’ve learned about the eligibility criteria, the application process, and the necessary documentation required to submit your form successfully. By following the guidelines outlined in this guide, you’ll be well on your way to taking advantage of this incredible opportunity to eliminate your student loan debt.

Recall, it’s necessary to stay organized, keep track of your payments, and submit your PSLF Form 2024 on time to ensure you’re eligible for loan forgiveness. Don’t hesitate to reach out to your loan servicer or the Federal Student Aid Information Center if you have any questions or concerns throughout the process. By doing so, you’ll be able to breathe a sigh of relief knowing that your student loan debt is one step closer to being forgiven. Take control of your financial future today and start working towards a debt-free tomorrow!

PSLF Form 2024: A Comprehensive Guide and FAQ

The Public Service Loan Forgiveness (PSLF) program is a federal program designed to help borrowers working in public service jobs manage their student loan debt. To apply for PSLF, borrowers must submit the PSLF form, which can be a complex and time-consuming process. In this guide, we will provide an overview of the PSLF form for 2024 and answer some frequently asked questions.

What is the PSLF Form?

The PSLF form is a required application that borrowers must submit to FedLoan Servicing, the PSLF loan servicer, to track their progress towards forgiveness and to apply for loan forgiveness. The form requires borrowers to provide information about their employment, loans, and qualifying payments.

Who Should Submit the PSLF Form?

Borrowers who are working in public service jobs and have Direct Loans or Federal Family Education Loans (FFEL) may be eligible for PSLF. This includes: * Government employees (federal, state, local, or tribal) * Non-profit employees (501(c)(3) organizations) * Teachers * Nurses * Public health professionals * Military personnel * Law enforcement officers * Public librarians * School librarians * Other public service professionals

When Should I Submit the PSLF Form?

Borrowers should submit the PSLF form annually or whenever they change employers. It’s recommended to submit the form as soon as possible after October 1st of each year, as this is when the new application period opens.

How Do I Submit the PSLF Form?

Borrowers can submit the PSLF form online through the FedLoan Servicing website or by mailing a paper application. The online application is recommended, as it allows borrowers to upload required documents and track their progress.

What Documents Do I Need to Submit with the PSLF Form?

Borrowers will need to provide documentation to support their employment and qualifying payments. This may include: * Pay stubs * W-2 forms * Letters from employers * Loan statements

PSLF Form 2024 FAQ

Q: What is the deadline to submit the PSLF form for 2024?

A: There is no specific deadline to submit the PSLF form, but it’s recommended to submit it as soon as possible after October 1st of each year. This allows borrowers to track their progress towards forgiveness and ensures that they don’t miss out on any qualifying payments.

Q: Can I submit the PSLF form if I’m still in school or in a grace period?

A: No, borrowers must be actively repaying their loans to submit the PSLF form. If you’re still in school or in a grace period, you should wait until you enter repayment to submit the form.

Q: Do I need to submit the PSLF form for each loan individually?

A: No, borrowers can submit one PSLF form that covers all of their qualifying loans. However, borrowers will need to provide information about each loan, including the loan balance and payment history.

Q: What happens if I forget to submit the PSLF form?

A: If borrowers forget to submit the PSLF form, they may miss out on qualifying payments and delay their progress towards forgiveness. It’s imperative to submit the form annually or whenever employment changes to ensure that borrowers receive credit for their qualifying payments.

Q: Can I appeal if my PSLF form is denied?

A: Yes, borrowers can appeal if their PSLF form is denied. Borrowers should review the denial letter to understand the reason for the denial and provide additional documentation to support their application. Borrowers can appeal online or by mail.

By understanding the PSLF form and submitting it accurately and on time, borrowers can ensure that they’re on track to receive loan forgiveness through the PSLF program. Remember to submit the form annually or whenever employment changes, and don’t hesitate to reach out to FedLoan Servicing if you have any questions or concerns.